I am also just a typical guy who comes from a middle-class family, has taken out some personal loans, made basic personal finance mistakes, and also, I was a little late to investing (I started at 24, I wish I should’ve started at 20 at least). I’ve only been actively investing for the past two years.

I stated at the beginning of this year that I have an end corpus in my mind. If I achieve it, I will share my portfolio online. Here I am, and I have achieved it.

Before we begin, let me say that my goal is not to flaunt or flex how much money I have put into this. I’m doing this in the hope that it will help anyone who is watching achieve their financial goals.

For some, the amount may appear small, while for others, it may appear large. But for me, it’s a decent sum when I consider where I was two or three years ago, and I feel good about having met my financial goal for the year.

The corpus I aimed for in 2022 was 5,50,000 INR, and yes, that’s what I achieved.

Let’s take a deep dive into it.

At last year’s end, my investment in equity was approximately 50,000 to 60,000 INR plus 75,000 INR in my PF account.

My corpus was around 1.3 or 1.4 lakhs when I first started this year(2022), with the majority of it coming from my PF investment (in my previous year, I was contributing Voluntary PF(VPF) in addition to my PF and my employees PF).

Just so you know, I haven’t included my emergency corpus or my investments on short-term goals (which will be spent in the next year)that have been invested in an arbitrage fund.

The portfolio I’m going to share is the one for my retirement; apart from that, I don’t have any long-term goals as of now.

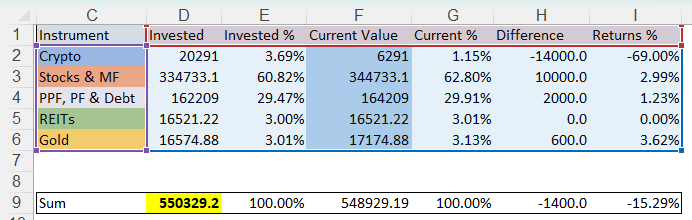

Below is my entire portfolio and let’s see the asset allocation one by one,

Don’t take the return percentage of equity seriously; I have booked a profit of INR 25,000 this year from the equity that’s not added here.

If you look at my investments, its asset allocation is 35% in fixed income (PPF, PF, Debt MF, and Gold) and 65% in volatile assets (Crypto, Stocks & Equity MF, REITs).

One can use two ways for their asset allocation, one is 100 – age should be in equity. I am 26 now, I can use 100 -26= 74% of my portfolio in equity.

The other option is to just follow the 60:40 portfolio mentioned in the “Intelligent investor” book. 60% in volatile assets like equity and 40% in fixed income.

I want to stick to 35% in fixed income and the remaining 65% in volatile assets for the next 4 years (till age 30). After 30, I will shift to a 60:40 portfolio as suggested in Intelligent investor.

Now let’s look at my investments in each asset one by one.

Fixed income

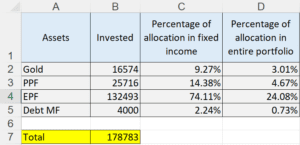

In Fixed income, I have PPF, EPF, Gold, and 4 debt mutual funds.

PPF & EPF

The majority of new investors forget to add their PF investments to their net worth. It’s also your money, right? Once you’ve added, you might know that your fixed income is greater than your equity exposure.

Last year, I thought I had fully invested in equity and needed to add some fixed-income instruments. Then I remembered my PF: when I included it in my net worth, my fixed income was nearly 75% and my equity was only 25%. I thought I was investing more in equity, but I wasn’t.

Even if you desire a 60:40 allocation, it requires more equity in the initial stages of investing as the PF investments will be increasing every month.

PPF: PPF has money-added values; I can even make a separate post about it. In short, it has a 15-year lock-in period and generates 7.1% interest, which is all tax-free during withdrawal. If your company is not providing a PF account for you, then I recommend that you open one for yourself at a bank. Annual contributions can range from 500 to 1.5 lakh. I made an investment of 25,716 INR.

EPF: This is the normal employee’s provident fund account for salaried individuals, where my VPF also goes. 1,32,493 INR was my contribution to the EPF.

Debt Mutual Funds

Two years ago, I invested in four debt mutual funds, each costing a thousand rupees. I invested because I thought I had no fixed income; later, I added my PF account. Then I never invested in debt funds after that, but I still keep those funds with the hope that in the future I will exceed my equity contribution (> 65%), and during those times I can use these funds for rebalancing to meet my fixed income values of 35%.

Gold

As gold is inversely proportional to equity. Gold can act as a hedge during natural calamities, a war, or a bear market. I’m considering always keeping gold at 5% of my portfolio. I have reached 3%; I need to push two more percentage points.

I am using gold bees to buy gold; a total of 16,574 INR is invested in gold bees.

A total of 1,78,783 INR in fixed income which contributes 32.49% of my entire portfolio value (5.5 L) and moving on to volatile assets.

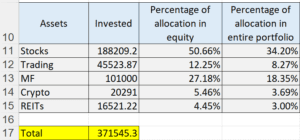

Volatile Assets

Volatile assets include crypto, equity, REITs, and InvITs

Crypto

I invested INR 20,291 in cryptocurrency last year May, despite knowing nothing about it and investing solely in speculation. Within a month, it fell to 55%. Now I have only 6,000 rupees in crypto. Even if cryptocurrency has the ability to produce 10x returns, it could also do so in the opposite direction, and I don’t have the stomach for it.

My investment in crypto is 3.69% of my entire portfolio, which is a risk I can afford to take. But taking an exposure of>5% crypto is too high.

My advice is to stay away from crypto.

Stocks & Mutual Funds

I have cluttered as much as I can in equity segments. I have a trading account in my mother’s name, long-term stock investments in my name, and additionally mutual funds.

- Stocks – 50.66% of my equity portfolio

I’m investing in low-volatility stocks with lower debt; I’ve already shared my stock portfolio in this post; check back later.

- Trading – 12.25% of my equity portfolio

For trading, I use only ETFs like Nifty IT, Pharma, Auto, FMCG, and Bank. All are cash market trades (delivery).

- MF – 27.18% of my equity portfolio

I own nearly ten mutual funds, all for less than Rs one lakh. I messed up by adding three ELSS funds that will be with me for the next three years even if I want to withdraw, as well as a few other funds that I invested in before learning about mutual funds.

I am trying to declutter my portfolio; everything is here and there. I must refine it into fewer stocks and mutual funds. In my mind, I have 4 mutual funds and 10 stocks for the long term, and I need to declutter others in the coming years.

REITs & INVITs

I have four REITs and InvITs in which I invest for dividends. My goal is to have 5% of the total portfolio in REITs and InvITs. Now I have 3%.

A total of 3,71,543 INR in volatile assets which accounts for 67.51% of my entire portfolio. That’s all about my portfolio.

How I was able to do it

I was following these things to save and invest,

- Pay yourself first: As said in the book “The Richest Man in Babylon,” – “Pay yourself first.” Whatever your salary may be, pay yourself first. You’ve got to take one-tenth of your salary for yourself. Even if it’s less than INR 10,000, you must set aside 10%, i.e., INR 1,000, for savings or investments. When my salary is credited, I take the investment amount separately and never touch it again.

- Paco’s Law: To reduce my overspending habit, I followed Paco’s law “your spending will equal what you have available to spend.” A week before, I used to list out my needs and wants for the next month, and then I funded them into two separate bank accounts. With this method, I was able to save a little more and add it to my investment.

- Money manager: One good habit that I’ve been following for the last 4 years: using the “Money Manager” app. It gives me a birds-eye view of my spending in a month. At the end of each month, in a matter of 30 seconds, I’ll be able to find where I’ve spent a lot and that helped me to correct.

The takeaway for young investors

Especially for young investors like me, I’d like to share a few of these,

- The first 5 years of investing are called the accumulation phase, and I am also in an accumulation phase. Attempt to invest as much as possible in the first five years, giving ourselves enough time to compound. After 5 years, you can reduce the phase a little bit as you get hooked on a few family responsibilities like marriage & children.

- Before investing for the long term, make sure your family’s health insurance, term insurance, emergency fund, and short-term goals are all taken care of. Having these things in check can be expensive. We are just keeping the odds in our favor. Our short-term expenses in life, like medical expenses or meeting our near-term goals, can cause us to break our investment, which in turn breaks the compounding effect. It is not a problem for us to have them in our lives, but we should prepare for them individually and invest; avoid using our long-term portfolio for short-term objectives.

- I invested around 4 lakh rupees this year. I have been investing roughly 33,333 INR per month (which also includes PF), which is a good sum when compared to the 1.3 lakhs I invested the year before. I want this to increase every year. More than returns, what we need to care about is principal. Because it is the principal, not the return percentage, that will make you wealthy. (See later.) Change your thinking immediately if you believe that your investment returns will make you wealthy. The key is the principal amount invested.

- To invest more, you need more money; for that, improve your skills if required and seek a better job to meet all your needs and financial goals. Fortunately, I switched companies this year, and that was the major reason for me to invest more without caring about the returns.

- Have a long-term view before investing. Have a goal for your investment before starting; don’t invest and try to fit a goal into your investment. Don’t make the same mistake I did and invest in everything without a plan, cluttering your portfolio. Thank goodness I didn’t have any near-term commitments; that can be the situation for everyone. So, from now on, look ahead to 10 to 15 years.

Until next time,

Peranesh xx