Any product you buy comes with a price tag; mutual funds are no different. All the personal finance gurus say to stick to index funds instead of active funds and choose a direct plan instead of a regular plan in mutual fund investing.

The reason for that is that the expense ratio of an index fund will be much lower when compared to an active fund. The same applies to direct vs regular plans—direct plan expenses are less than regular.

So, in the long term, the expense spent on an index fund and direct plan will be less than for active funds and regular plans, and most retail investors also know this.

Here, in this post I’ll share how the expense ratio is calculated and how it will impact your portfolio if you haven’t taken it seriously yet.

Let’s dive deep into it.

Total expense ratio (TER)

The expense ratio is the annual fee the Asset Management Company(AMC) charges the investors for managing their funds.

Each year, the mutual fund AMCs must pay operating expenses like employee salaries, customer support, marketing and distribution fees, etc. In short, the expense ratio is the number of costs incurred to operate a specific mutual fund.

Math time

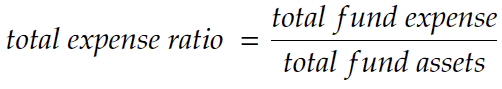

Let’s assume you are going to invest 10 lakhs in a fund that generates 20% average returns per annum for 15 years.

You might have used this formula in your school days, wondering where you’re going to use it in life. Well, here you go

Your 10-lakh investment after 15 years is turned into 1.54 crore in value with 20% interest per annum. This should be the actual corpus after 15 years compounded.

Keep this value in mind and let’s see the examples with expense ratios involved.

Note: The expense ratio changes from time to time. The expense ratio which I’ll be sharing below is the current expense of the funds as of writing this post. Other than the expense ratio, things mentioned like principal, returns, and tenure are imaginary values.

Scenario #1 – Direct vs. Regular

I’m going to compare two plans of one fund—Franklin India’s blue-chip Equity Direct Plan and its regular plan and put them in the above formula. Let’s see how much we’re losing in expense…

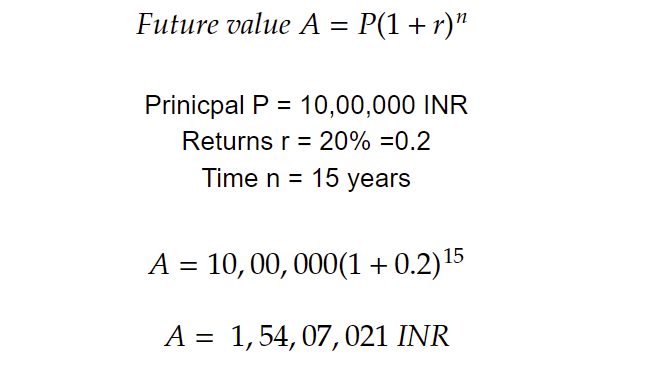

Franklin India blue-chip equity – direct

Here, the expense ratio for a direct plan is 1.17%. So, I’ve subtracted the expense ‘e’ from the returns ‘r’.

See, your investment has deteriorated all the way from 1.54 crore to 1.33 crore for an expense of 1.17% which is 21 lakhs.

I’ve taken the Franklin India fund because it has quite a high expense ratio to show that if you blindly buy a fund without seeing the expense ratio, it can cost you a lot, like in the above instance.

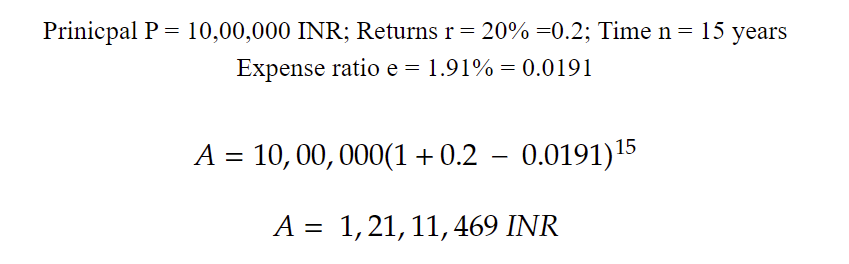

Franklin India blue-chip equity – regular

Now, with the regular fund, your investment goes further down to 1.21 crore. This means the 21 Lakhs went for AMC expenses and the additional 13 lakhs went as a commission to brokers, for a total of 33 lakhs.

It’s like they are taking 1.xx% of returns from your 20% return every year and that 1.xx% compounded annually, makes a whooping difference of 20 to 30 lakhs (approx.) from your end corpus.

Scenario #2 -Index vs. Active

Here I’ve taken UTI Nifty 50 Index fund with Canara Robeco Blue-chip Equity fund(Active) both are direct plans.

This is one of the very few active funds which beat the index last year, so I’ve taken this as an example and assumed Canara Robeco and UTI have generated the same returns, 20% in this instance, and let’s see how much of a difference they make.

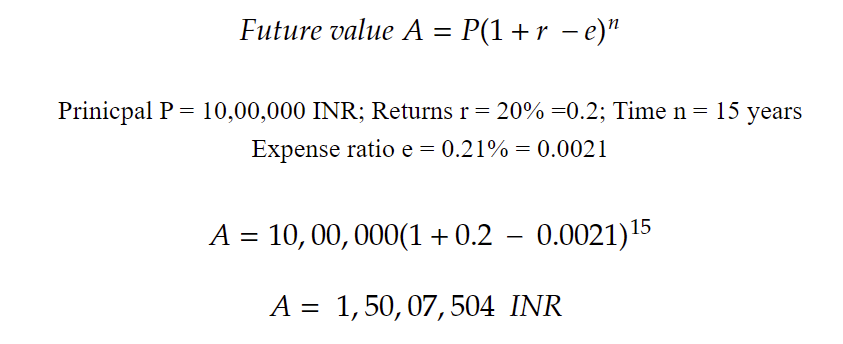

UTI Nifty 50 index – direct

Your corpus should be 1.54 crore but here it is 1.50 crore and just an expense of 4 lakhs for 15 years is something our minds can agree on, it doesn’t make a difference in our end value.

Index funds don’t need many resources or analyses to run like active funds. Just copy the index and monitor.

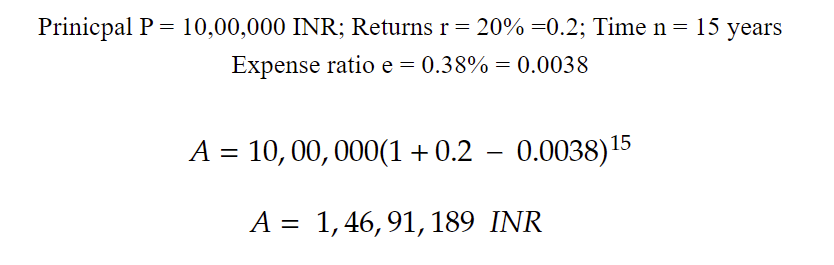

Canara Robeco blue-chip (active) – direct

Here in this active fund, it is 1.47 crore, an additional 3 lakh expense than an index fund.

A total of 7 lakhs, which is also quite considerable to afford for 15 years, and manage to make 1.47 crore. But this is considered only in the case if it has beaten index funds where most of the funds fail to do.

Then why do we need active funds?

Luckily, Canara Robeco blue-chip beat the index fund last year, but it doesn’t mean it’ll do the same for the next 10 or 20 years.

If your active funds’ annual returns beat the index, then you’re safe, no need to care about the little bit of high expense which will be compensated by the index beating returns.

Things to Remember About the Expense Ratio

- Don’t be worried that the expense ratio will be deducted when you withdraw from the fund, the returns shown on your fund are deducted with the expense.

- In fact, the expense ratio is deducted from your investment daily

- example, 5000 INR deposited in a fund with an expense ratio of 2%, then (2%/365=0.0054%) will be deducted from the investment each day (0.27 per day).

- example, 5000 INR deposited in a fund with an expense ratio of 2%, then (2%/365=0.0054%) will be deducted from the investment each day (0.27 per day).

- In fact, the expense ratio is deducted from your investment daily

- Don’t choose a fund because it has a low expense ratio. The fund also needs to align with your investment objective. Don’t go blindly with a lower expense ratio.

- Some might think they’re charging high expenses so their returns will be high. A higher expense ratio doesn’t mean it’s a better fund, a fund with a lower expense ratio can equally or more capable of producing better returns.

- Expense ratio’s impacts on debt find will be high because they generate fewer returns compared to equity.

- Example: A fund with a return of 7% and an expense ratio of 2%, you get only 5% then the fund is ill-equipped to beat inflation.

Buffett’s Million💲bet on Index fund

In 2008, Warren Buffett made a bet with Ted Seide for 1 million dollars. The bet is that over the next 10 years Buffett’s chosen Vanguard S&P 500 index fund (like our nifty index) will beat Ted’s 5 baskets of hedge funds.

In 2016, Ted lost and Buffett won the bet. The reason is that the high expense ratio of active funds cannot beat the low expense ratio of index funds over a long-term period.

Hope you’ve now got to know how expense ratio can impact a fund if you choose a regular instead of a direct plan, or an active fund instead of an index fund (if the active is not able to beat the index).

Until next time,

Peranesh xx 🍀

If you like this post, you may also like these too