I have done this audit before the new year, but I am a bit late in posting here. Before getting into my 2023 audit, please have a look at my 2022 audit (if you like to).

Let’s dive now.

I have two portfolios for two of my goals: one is for my retirement (FIRE), and the other is for my short-term goals (the things that need to be taken care of in less than 5 years).

First, we will have a look at my retirement portfolio.

1. Retirement Portfolio

As i said in my 2024 new year goals post, in 2022 I achieved 5.5 lakhs of corpus for my retirement, and in 2023 I aimed for 10 lakhs, and somehow I was able to crunch it this time as well to my target corpus value.

- 2022 – 1.4 L

- 2023 – 5.5 L

- 2024 – 10 L

For some, the amount may appear small, while for others, it may appear large. But for me, it’s a decent sum when I consider where I was two or three years ago, and I feel good about having met my financial goal for the year.

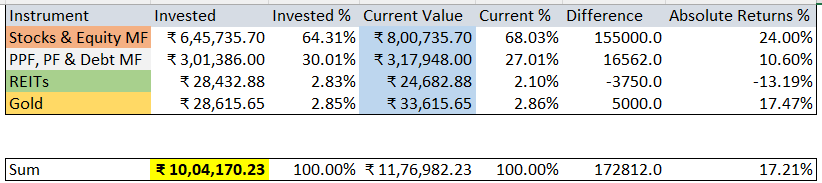

Below is my asset allocation.

As I said last year, I am sticking to a 65:35 asset allocation strategy (65% in equity and 35% in fixed income). I am 27 years old, and I think I am good to have up to 70% exposure to equity, but I am still sticking to 65% equity. As of now, it is 68%; if it touches 70%, I’ll rebalance 5% from equity to fixed income.

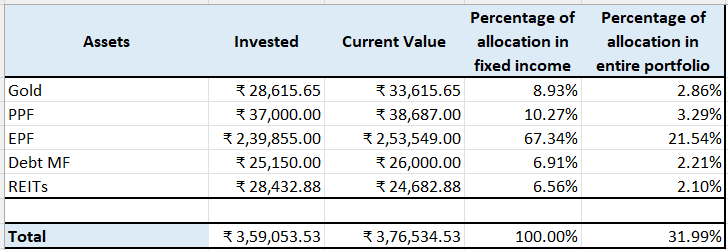

Fixed Income

In fixed income, I have diversified into EPF, PPF, gold, debt mutual funds, and REITs, which make up 31.9% of my entire portfolio.

Previously, I added REITs to my equity asset class; I was wrong. Since REITs and InVITs offer dividends every quarter as a steady income, And it won’t grow at the speed of equity stocks; returns from REITs and InVITs will be very low. So, it is better to assume it is a fixed-income asset class.

It may seem like I have little exposure to gold, PPF, debt MF, and REITs. Yes!. But I have invested in them with the future in mind (especially during rebalancing time) and for diversification purposes.

My Target: I can’t reduce my EPF exposure, so going forward, I have to start investing more in other fixed-income assets in my portfolio. At the time of portfolio rebalancing, I can move the money to PPF and Debt MF, which may help increase their exposure. For gold and REITs, I want to keep them always less than 5%.

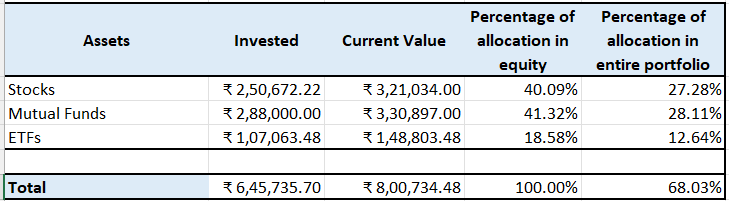

Equity

In equity, I have diversified into direct stock investing, equity mutual funds, and ETFs (earlier, I started trading, but I am not doing it anymore). 68.03% of equity from my entire portfolio.

Stocks – 40.09% of my equity portfolio

I had a good run in stocks last year and am sitting on a decent profit compared to the market. The CAGR of my stock portfolio is 23.33%, and the gain from dividends is 2.63%.

Equity mutual funds – 41.32% of my equity portfolio

This is where I first started, but later direct stock investing took over, and somehow this year I have managed to invest more in mutual funds to increase their exposure. The XIRR of my mutual fund portfolio is 31.1%.

Another thing is that I want equity mutual funds to have more exposure than direct stocks. Because direct stock investing is a double-edged sword. So, it’s better for me to always rely on mutual funds.

ETFs – 18.58% of my equity portfolio

I started this as a trading strategy, but later I got settled on it as a long-term investment because of its solid performance and potential to grow in the future. The CAGR of my ETF portfolio is 25.44%.

My Target: Right now, 68% of my portfolio is in equity; if it reaches 70%, I’ll take 5% from equity and move it to fixed income for rebalancing. And, high exposure in equity mutual funds (+10%).

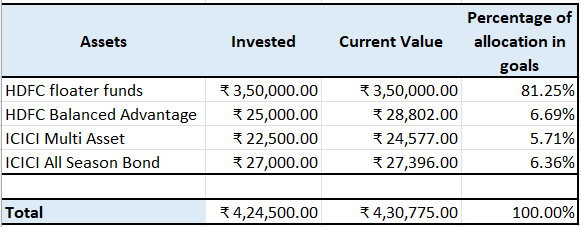

2. Short-term goal-based portfolio

I have a few less than five-year goals; for that purpose, I am using debt and hybrid funds for this portfolio. I won’t take the returns seriously in this portfolio; anyway, money from these funds will be spent on my goals in a short span. For me, more than returns, I need money from this portfolio when there is a need for my short-term goals. There is nothing much about it. I churned around 30K in this portfolio this year.

My experience from 4 years of investing

- Stay away from the asset class, which you don’t know much about. One of the major changes from last year in my portfolio is that I’ve exited crypto. I did it for speculation, and I ended up with a -50% loss and waited for a year to recover. There was no sign of upward momentum, so I withdrew from it. If you don’t know an asset class, don’t invest in it.

- Don’t run behind returns. Instead of chasing the CAGR of your asset classes, focus on the CAGR of your yearly investments. Try to increase at least 10% every year compared to the previous year; this will make a huge difference in your journey to retirement.

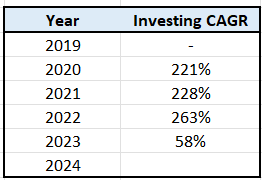

Last 4 years investing CAGR% - Always, always, always “Pay yourself first” – Whatever your salary may be, pay yourself first. You’ve got to take one-tenth of your salary for yourself. Even if it’s less than INR 10,000, you must set aside 10%, i.e., INR 1,000, for savings or investments.

- Have a long-term view before investing. Have a goal for your investment before starting; don’t invest and try to fit a goal into your investment.

- Overspending habit – “Your spending will equal what you have available to spend”. Try to track your spending and limit it, or invest one-third of your salary each month. By investing one-third, you’ve done your investment right, and you can use the remaining amount for yourself.

until next time,

Peranesh xx

see previous audit,